PRIME SERIES

Despite the rise

of consumerism the retail industry may be experiencing its greatest challenges

in history. The entrance of digital

technology to the retail process has created opportunity for some and threats

for others. Retailers must deliver a

shopping experience that gives consumers the immediacy and personalization they

have experienced on other digital platforms.

Younger shoppers are also adept at mixing on-line and in-store channels

for a single purchase and are disappointed with those retailers that confine

them to a single path.

It all sounds

very modern, but even retailers who serve customers across multiple channels

and are ever present through mobile connectivity still struggle for financial success. The problem is that contemporary shoppers

have penchant to order merchandize and send it back. Costly returns have become the bane of

merchants.

A solution to retailer’s

returned merchandise problem comes from My Size, Inc. (MYSZ), a developer of

sensor-based measurement technology. The

My Size measurement tool can be used in digital shopping and shipping channels

to make certain buyers get things right the first time.

MySize is a

fledgling company and has not yet captured revenue or profits from its measurement

innovation. However, a growing string of

new relationships in its target markets suggests the company is about to turn

the corner to success. The timing could

not be better for investors to look closely at MYSZ shares.

Swipe for customer service…

As consumers

have shifted their buying activity to online platforms, their selection

behavior has changed. Many buyers order

a product with a plan to immediately return some or all items in the

order. As a consequence, ‘returns’ to

the seller have increased by five times compared to the frequency of items

being taken back to brick and mortar stores.

According to eMarketer return rates are in a range of 8% to 10% in brick

and mortar stores, but are double that for e-commerce sites. Half of high-ticket items or luxury goods are

returned for store credit or refunds.

Returns cost

retailers in restocking activity, goods lost to damage in handling or losses in

shipping. Retailers are experiencing

lower profit margins and weakened conversion rates from online advertising and

promotions. Reverse Logistics

Association reports that the return and repair process accounts for 10% of

total supply costs.

The high cost of

returns does not end in the retailer’s back room. The average cost of a return label for shipping

with the top logistics carriers is $6.75.

Statistica estimates that in 2020, return deliveries could cost as much

as $550 billion. The astounding number

is 75% higher than just four years earlier.

The Fitting Room

The number one

reason for merchandise returns is that the size is wrong. Return Magic recently completed a survey of

1,000 business and compiled data from 800,000 customers of the online retail

platform Shopify. The study found 30% of

customers returning merchandise thought the product they got was too small and

22% found the product too large. My Size

management cites data suggesting that size is the culprit in as much as 80% of

returns of merchandise bought on-line.

One solution to

reduce returns and improve customer experience may be to replicate the accuracy

of the brick-and-mortar fitting room.

My Size Solution

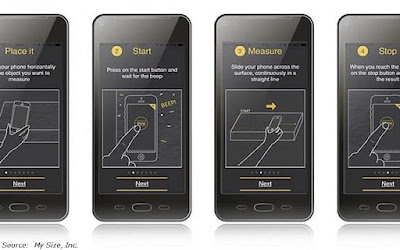

My Size has

developed a mobile application called MySizeID

that turns the smart phone into a measurement tool using sensors already built

into the device. The user’s home or

office can be transformed into a private fitting room. Users are provided a tutorial video that

shows exactly how and where to place the smartphone so measurements are

accurate.

The app records personal

measurements that are saved on a secure and encrypted server for future

reference when the user shops for garments from a participating on-line

retailer. While shopping online the user

clicks a MySizeID widget or icon on

the retailer’s site to receive an immediate size recommendation based on a

comparison of their particular data and the retailer’s size charts.

Retailers can

license the MySizeID app directly or

display their own branding on a white label version. MySizeID

is the only sizing solution that allows its Standard Development Kit or SDK to

be integrated with the retailer’s app so customers do not have to switch back

and forth between apps. There are both Apple

iOS and Google Android versions of MySizeID,

exposing the app to the vast majority of smartphone users.

Box Size Does Matter!

The cost burden

of returned merchandise is not confined to product recovery. Retailers are also hit by higher shipping

costs, especially if the retailer has offered free returns. On-line retailers already have a shipping

cost issue on the original order if that have promised flat rate shipping or

offer free shipping on orders over a certain value.

At least two of

the major shipping and logistics services providers for e-commerce, UPS, DHL or

FedEx, apply dimensional weight to every package picked up by their

drivers. As a consequence for a given

weight the larger the box measurements the higher the shipping charge. Entering correct box size can yield shippers

big savings.

My Size offers

the BoxSizeID mobile app for

measuring a package using a smartphone.

The app then calculates shipping costs and arranges for package

pick-up. BoxSizeID is also available on both iOS and Android platforms.

Size of the Matter

The core of My

Size’s technology is encompassed in SizeIT,

a measuring tape Standard Development Kit or SDK. It is this SDK that is activated when users

measure objects by moving the mobile device from one side to the other. The Company’s patented algorithm relies on

motion sensors already embedded in the smartphone to calculate the

distance. SizeIt encompasses the foundational technology for the MySizeID and BoxSizeID apps as well as a third product called the SizeUp ‘smart’ measuring tape app.

My Size has

built a robust platform encompassed in its SDK that gives retailers a

plug-and-play solution. It can be easily

set up and managed by the retailer. By

standardizing features in the SDK, the platform can be economically deployed

without time consuming and costly customization. MySizeID

licensees are given a one-month trial period to evaluate the performance of the

technology and their set up under live, real-time shopping conditions.

The MySizeID has already been adopted by top

on-line shopping platforms, Shopify and Lightspeed. Shopify offers the MySizeID to all its retailing partners at a flat monthly fee,

explaining the app as a means to ‘help shoppers pick the rights size, every

time.” Lightspeed tells its retail

partners to “forget about return shipment hassles or costs” with MySizeID. The most recent convert to MySizeID is Penti, a Turkey retailer backed

by the Carlyle Group. Penti has set a

goal of cutting return rates in half.

Ramp to Recurring Revenue

Getting more

retailers and on-line platforms signed up is the key driver of My Size revenue

streams. The company receives a license

fee every time one of its apps makes a size recommendation. Management has indicated it expects as many

as 20 million size recommendations in 2020 from platforms already signed up or

in trial at the time this article was published. Fees vary depending upon the agreement in

place and could range from just a penny to a dime for each size recommendation.

Investors can

expect to see ramp in initial revenue in 2020.

Management plays it down because it will take time to drive the pace of

recommendations. However, as the app is

downloaded and put into use, recommendations should build and My Size license

fee will follow. Earnings should be

right behind as management expects profit margins typical of

software-as-a-service business models.

Competition

There are other

developers who have recognized the need to get the right fit in e-commerce. However, not all the available apps actually

‘measure’ and others stop well short of determining size.

True Fit is an app recognized by My Size management as a potential

competitor. In our view, that is a

generous view on what True Fit can accomplish.

Users select their body type and provide a bit of information about

brands they like and indicate the sizes of any clothing items they already

own. From that little bit of

information, the app divines the correction size you need to the garment you might

buy next. Then every time the consumer

shops for a True-Fit rated garment the consumer’s recommended size will pop

up. No measurements needed, but shoppers

dare not gain or lose an ounce! We might not be impressed, but more than 3,000

items have been rated by True Fit on Nordstrom.com and there are at least a

dozen other retailers such as Brook Brothers that are also signed up with True

Fit.

Another player

in the measurement field is Upcloud’s Size Advisor, which also relies on

the user to know and accurately enter body measurements into the app. Size Advisor then compares that data to the

selected garment to render a recommended size and offer fit commentary. North Face and QVC Shopping Network have adopted Size Advisor

for their respectively e-commerce sites.

My Size management

also recognizes Virtusize as a potential competitor, in part perhaps

because it has been adopted by over two dozen online retailers including

Esprit. This app also relies on the

sizes of garments you already own to compare to the new item you intend to

purchase. By contrast MySizeID users do not need to know their

old sizes, and can rely on the easy-to-use app to get an accurate and current

size measure and recommendation.

The player for

My Size to beat could be Me-ALity with its in-store kiosk. Users must go to a Bloomingdale’s

brick-and-mortar store at least once and enter the Size-Matching Station for a

free-scan that collects 200,000 points of data.

The stations use the same technology as the full-body scanners used at

airports. The app renders the best-fitting

styles and sizes for garments sold by partner brands. More than 150 different sites use Me-Ality, including

Bloomingdales, Banana Republic and Vince Camuto. My Size management does not see a threat from

Me-Ality, perhaps because the service is available at just a few stores in New

York and California.

Measuring tape

apps are also circulating in My Size’s target market. EasyMeasure uses the camera on a

mobile device to calibrate the distance between two points on images captured

by the camera lens. The app is available

on both Apple’s iOS and Google’s Android smartphone and tablet platforms. AR MeasureKit is another measurement

app available on the iOS devices that depends on the device camera and

augmented reality technology to calibrate point-to-point distances. A similar measurement tool called Smart

Measure is available on the Android platform.

Importantly, My

Size has four issued patents to protect its intellectual property in Japan,

Russia and the U.S. Another eighteen

patent applications are pending that could give the company more protection

from competitors trying to copy My Size measurement algorithms.

Working Capital

The presence of

several avaricious competitors gives My Size some incentive to move swiftly on

the large market opportunity for sizing solutions. As investors know, it takes a well fortified

balance sheet, specifically ample working capital, to really put the pedal to

the metal.

My Size reported

$2.6 million in cash on its balance sheet in September 2019, the last time the

company reported financial results.

Working capital was $2.5 million, excluding an allowance for warrant and

derivative liabilities. That might seem

like ample resources, except My Size has been using about $450,000 in cash each

month to support operations. At that

rate of spending, the September 2019 cash kitty would have lasted about five

months or until about the end of February 2020.

To get prepared,

in January 2020, the company completed a direct offering of its common stock,

raising $2.0 million in new capital. The

added cash extends My Size runway for an estimated four more months.

We also note

that My Size has an ‘at market’ equity sales agreement with investment banking

firm H.C. Wainwright for up to $5.5 million in common stock. Reactivation of the sales agreement would

require filing a new shelf registration with the U.S. SEC, but this does not

seem to present an insurmountable obstacle to opening up that source of

capital.

‘Returns’ Value

Puns aside,

there could be an interesting return to holders of My Size shares. There is plenty to give investors confidence

in My Size future success: a highly

competitive, leading-edge product, a series of new relationships to deliver

fast market penetration, a high-margin business model, and access to capital

for growth. Investors in the recent private placement

bought My Size common stock at $3.89 per share, well below the current stock

price. Patient investors with the time

to wait for the expected ramp in revenue, MYSZ presents a compelling value

play.

Neither the author of the Small Cap

Strategist web log, Crystal Equity Research nor its affiliates have a beneficial

interest in the companies mentioned herein.

Underwriters of the Prime series may

have a beneficial interest in, serve as agents of, or act as advisors to the

companies mentioned herein.

No comments:

Post a Comment