Perhaps traders

just did not want to be distracted from shopping on-line for face masks and

self-quarantine supplies against the imminent threat of coronavirus. Indeed, the prospect of a dramatic upheaval

in the U.S. economy because of widespread illness and the efforts to contain it

appears to be driving market sentiment even if the potential economic effect is

lost entirely on policy makers.

Indeed, the

Federal Reserve action appeared to have just the opposite effect on investors

and traders. As the initial minutes

ticked by, the implications of the FOMC decision began to sound alarms across

trading rooms. If the FOMC saw

sufficient need to lower rates outside the usual meeting schedule, even after

declining to take the action at earlier dates, the committee members must see

something of significant concern. |

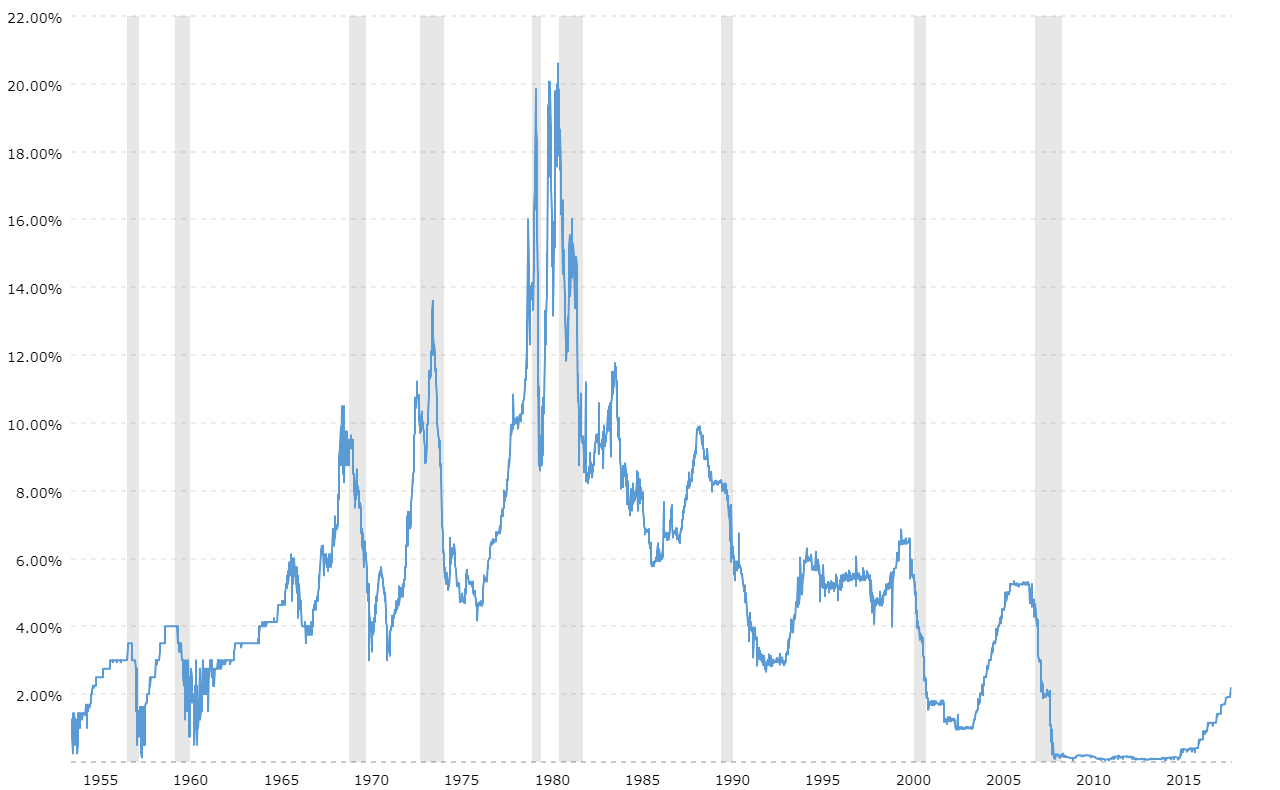

| Source: Federal Reserve, 62-year Fed Funds Rate |

Federal Reserve

Chairman Powell could not likely have found more disturbing words for his

explanatory statement: ‘evolving risk’, ‘material

impact’, and ‘highly uncertain’. It is

also alarming that the FOMC thought they could lower rates by 50 basis points

and all would be well even as they characterized the current economic situation

as subject to unquantifiable risk. It

suggests this group of banking and finance experts do not have a full

understanding of risk assessment.

There is never a

time that risk is not present in an equity market. Participants are constantly attempting to

quantify risk and adjust prices accordingly.

When new information comes available that suggests risk is greater than

previously measured, the market sells off.

Perhaps the FOMC

members and Power get it now.

Neither the author of the Small Cap Strategist web

log, Crystal Equity Research nor its affiliates have a beneficial interest in

the companies mentioned herein.

No comments:

Post a Comment