- Portfolio of three novel immunological therapies based on bispecific T-cell engager technology, each with differentiating performance against multiple cancers

- Enrollment initiated in first half 2025 for Phase I clinical trials for each of two therapies targeting several cancer types

- Sufficient cash resources to support work through initial data milestones from Phase I clinical trials as early as the first half 2026

- Targeted patient populations offer significant revenue opportunities that could yield strong returns on investment if regulatory approvals are achieved

- Strategic flexibility to embrace either unilateral development of each therapeutic candidate or collaboration with other sector players

- Potential valuation triggers as clinical

trials produce first data points on safety and efficacy within the next few

months

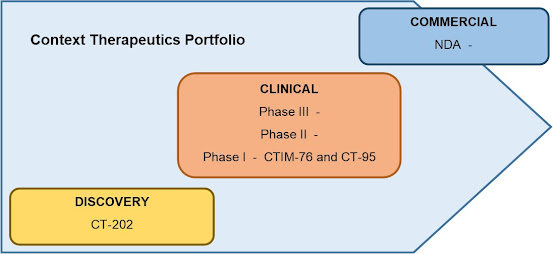

Context Therapeutics (CNTX: NasdaqCM) is a clinical stage biotechnology company developing treatments for solid cancerous tumors using novel Bispecific T-cell engaging (BS-TCE or B-TCE or BiTE) technologies. Considerable work has been undertaken in the BS-TCE arena, providing some confidence Context’s development work is properly focused.

The Company has

used both acquisition and in-licensing to build a portfolio of three

therapeutic properties, two of which have received approval by U.S. Federal

Drug Administration to begin testing with human patients. An $89 million cash kitty and access to estimated

$60 million in new capital through an at-market common stock purchase agreement

are providing adequate resources to achieve important milestones in the

Company’s first clinical trials.

Market

capitalization for CNTX is currently about two-thirds of book value despite

strong fundamental progress toward proving the merits of its therapeutic

candidates. The stock is also

registering as oversold based on commonly used technical signals. We expect news on clinical trial milestones within

the few twelve months. Favorable results

could jumpstart sentiment, tripling or quadrupling the stock price from the

current depressed level.

Accordingly, we

believe it is timely to take a long position in CNTX. Of course, even risk-tolerant investors

should undertake some due diligence. We

offer a few comments here on Context’s portfolio of therapies and the strength

of the Company’s financial resources. We

also make some suggestions on additional research for both newcomers to the world

of immunology as well as seasoned sector investors.

Anybody for

Antibodies?

Context has

joined a well-populated field of developers crafting therapeutic agents designed

to shift the body’s immune system into high gear, an increasingly popular

approach to cancer treatment. Advances

in genetics and greater understanding of the molecular structure of living

cells are facilitating the development of increasingly sophisticated

immunotherapies, usually administered to patients as an infusion.

The knights of

the human immune systems are white blood cells called T-cells. Working as a team with different jobs,

T-cells seek out invasive pathogens, lock on and try to destroy the target. One of the jobs is done by ‘helper’ T-cells

that stimulate B cells in the immune system to release proteins or antibodies

that identify and attach to foreign proteins or antigens. With the intruder identified, ‘cytotoxic’

T-cells directly bring about the culprit’s demise.

Biotechnology developers are working on ways to speed up the process and make the T-cells more effective as cancer fighters. In particular, Bispecific T-Cell Engagers (BS-TCE) are engineered molecules that can recognize and attach to two distinct targets simultaneously. This dual-targeting capacity allows the BS-TCE to bring two different molecules into close proximity – specifically an antigen of the culprit cancer and a white blood cell or T-cell that destroys pathogens. Indeed, T-cells need to get up close and personal with cancer in order to more easily recognize it as an intruder, become activated and then release its sauce of toxins into the cancer cell. By acting as a bridge between the T-cells and the target cancer cells, the BS-TCEs facilitate the process that gives the T-cell its ‘killer’ nickname.

Biotechnology developers are working on ways to speed up the process and make the T-cells more effective as cancer fighters. In particular, Bispecific T-Cell Engagers (BS-TCE) are engineered molecules that can recognize and attach to two distinct targets simultaneously. This dual-targeting capacity allows the BS-TCE to bring two different molecules into close proximity – specifically an antigen of the culprit cancer and a white blood cell or T-cell that destroys pathogens. Indeed, T-cells need to get up close and personal with cancer in order to more easily recognize it as an intruder, become activated and then release its sauce of toxins into the cancer cell. By acting as a bridge between the T-cells and the target cancer cells, the BS-TCEs facilitate the process that gives the T-cell its ‘killer’ nickname.

Context’s Portfolio

of T-Cell Engaging Technology

Context has

three bispecific T-cell engagers in the works for the treatment of solid tumors. Each therapy offers differentiating

characteristics that increase effectiveness and/or reduce the risk of

toxicity.

CTIM-76 - The most advanced of Context’s therapies was dosed to the first patient in January 2025 as part of a Phase I clinical trial aimed at determining efficacy and safety in treating gynecologic and testicular cancers. The Company refers to it as CTIM-76, and expects to share at least some of the initial data on the trial by the first half of 2026.

One arm of CTIM-76 locks with CD3, a proteign that is involved in activating the patient's helper and cytotoxic T-cells. CTIM-76 also targets a protein called Claudin 6 or CLDN6 that is over expressed in cancer tumors but does not appear in healthy tissue. CLDN6 plays a role in embryonic development and then goes silent as the human body matures. Cancers apparently co-opt CLDN6 to achieve fast growth. To poplated the Phase I trials current underway, the Company is looking for patients with CNDN6-positive gynecologic and testicular cancers.

Importantly, Context

scientists indicate their earlier research shows that CTIM-76 has

particular capacity to select CLDN6 over its cousin proteins CLDN-3, -4 and

-9. Indeed, cancerous tumors with even

low levels of CLDN6 can be attached by CTIM-76. This means CTIM-76 could prove

effective for a wider patient population and that has implications for revenue

opportunities and investment returns.

CT-95 - A second Phase I clinical trial has been initiated for Context's second therapy, CT-95. Context plans is enrolling patients with

advanced ovarian cancer, pancreatic carcinoma and mesothelioma.

CT-95 targets malignant cells expressing mesothelin or MSLN, a membrane

protein present in about 30% of cancers.

Like CTIM-76, the other arm of CT-95 binds to CD3, the

T-cell protein. Context scientists

believe their CT-95 candidate resolves difficulties previously

encountered with MSLN, which ‘sheds’ fragments into the blood and the tumor

microenvironment. Antibodies targeting

MSLN can be distracted by these competing fragments. However, Context’s CT-95 has

particular voracity for MSNL bound to a membrane, improving outcomes for

patients with higher potency and reduced risk of toxicity.

The Company

estimates 90% of ovarian cancer is positive for MSLN, while mesothelioma is 70%

and pancreatic cancer 80% positive. Data

presented in the Company’s annual reports suggest these three cancers together

represent nearly 90,000 new cases each year in the U.S. alone.

CT-202 - Sometime in the middle of 2026, the Company plans

to file with the FDA an investigational drug application for its third

candidate, CT-202. This T-cell engager targets Nectin-4 expressed on a

variety of cancer types. Of course, CT-202

also locks on the CD3 protein complex in T-cells. CT-202 is designed to become active in

the acidic or low pH environment of tumors, thus avoiding the neuropathy and

rashes that have been associated with Nectin-4. The Company’s investor

presentation dated May 2025, suggests five cancers in the target market with as

many as 125,000 patients per year.

Meeting the Solid

Tumor Challenge

Context is

targeting solid tumors with its innovative BS-TCE candidates. So far only one of the approved BS-TCEs have

been approved for solid tumors. Given

that vast majority of newly diagnosed cancers are solid tumors, we believe it

is worthwhile to become second or even third in line for this significant patient

population.

Treatment of

solid tumors with BS-TSE therapy is challenging. For example, BS-TSEs are dependent upon

recognizing antigens associated with the tumor, but most of the solid tumor

antigens are also expressed on normal cells.

This could lead to serious toxicity in surrounding healthy tissue from T-cells

misfire. Context’s candidates have been

designed to target a cancer antigen that is not present in healthy tissue,

reducing the likelihood of off-tumor toxicity.

Another hurdle in treating solid tumors is the diversity of their proteins

or antigens. Again, Context’s candidates

have been proven capable of sorting through and finding only a specific antigen.

Of course, this summary

is a simplification of the science.

Context’s public filings provide considerable detail on the Company’s

BS-TSEs. The 2024 Annual Report is a good place

to begin. Context’s Corporate Presentation is aimed at sector

professionals, but offers valuable details for everyone.

Context’s

Revenue and Profit Potential

Analysts like to

value the pipelines of pre-revenue biotech companies by calculating a

risk-adjusted net present value. Begin

with a few data points on market opportunity, sprinkle on some assumptions

about capture of market share, dosing prices and manufacturing costs. Then crunch it all together with a few

probabilities of success on the way to regulatory approval. Investors can estimate revenue and profits

for any one of Context’s therapies or development candidates.

Unfortunately,

it might be a bit early to predict when the Company could achieve FDA approval

of CTIM-76 and advance it to commercial stage. The Phase I clinical trial of CT-95 has not

even started. Any revenue or costs

numbers would quite speculative and warrant caution. Nonetheless, a look at potential addressable

markets helps put color into the picture.

Market

Opportunity Example - With just two cancer types under study in the Phase I clinical

trial for its CTIM-76 therapy, it appears Context has a fairly lucrative

target market for just that potential product alone. The American Cancer

Society indicates there are about 9,720 new cases of

testicular cancer diagnosed each year.

The National Cancer Institute estimates

in 2025 there will be about 20,890 new ovarian cancer cases and another 69,210

cases of uterine cancer. According to

data provided by the Company, about 95% of testicular cancers, 44% of ovarian

cancers and 51% of endometrial cases are CLDN6 positive.

Cancer

immunotherapy can be an expensive proposition for a patient. Monoclonal antibodies such as Keytruda

(pemgrolizumab) created in a laboratory are delivered via infusion that can

cost as much as $10,000 per month. Chimeric

Antigen Receptor or CAR-T therapies such as Yescarta (idecabtagene) that rely

on T-cells borrowed from the cancer patient and then modified in the laboratory

can cost as much as $375,000 per treatment.

Alternative

Top-down Approach

- It is noteworthy that unlike CAR-T therapies, for example, bispecific

antibodies are more or less ‘off the shelf’ treatments. The key for patients is the ease physicians

will have in identifying individuals who are likely to respond to particular

bispecific antibody treatments. Then dosing adjustments will make it possible

to craft personalized care for each patient.

These factors have significant implications for improved outcomes and

reduced treatment costs, potentially shifting physicians’ preferences to BS-TSE

therapies.

Thus, another

approach for investors is to take a global look at the total market for

bispecific antibodies. By the end of

2024, the U.S. FDA had approved a dozen bispecific antibodies. With these approvals in mind, Mordor Intelligence has estimated

the bispecific antibody market size is near $9.8 billion in the current year

and could grow at an impressive compound annual rate of 18% through the year

2030. The exceptional growth rate is a

combination of the rising prevalence of cancer and accelerating approvals of

new treatments.

The question is

what portion of this very large and growing market would Context be able to

capture.

Financial

Resources

Without

financial resources to support clinical trials and further laboratory

development, discussion of revenue potential is nothing more than an academic

exercise. Fortunately, in May 2024, Context

was successful in raising $100 million in new capital through the private

placement of common stock.

At the end of

March 2025, the Context reported cash resources totaling $89.4 million. Excluding cash, current assets exceeded

current liabilities by $1.5 million.

Management estimates its cash kitty is sufficient to support operations

into 2027, including the dose escalation period in the Phase I trials of CTIM-76

and CT-95.

We note the

Company used $5.0 million in cash resources to provision its activities in the

three months ending March 2025. We

expect the cash usage rate to increase when the Phase I trial for CTIM-76

enrolls more patients and as the Phase I trial for CT-95 begins. It is estimated the current bank balance could

last until the first quarter of 2027, even if cash usage doubles to $10 million

per quarter.

Additionally, Context

has an agreement in place to sell common stock shares at-market to an

investment banking firm. We estimate the

remaining balance available to the Company is near $60 million after report of net

proceeds of $14.5 million related to sales under the agreement up through December

2024.

Management’s guidance on cash resources means the Company will likely have at least some data points from its Phase I clinical trial of CTIM-76 before the team will need to pass their hats again for additional capital investment. Promising data could have a lubricating effect on valuation, protecting incumbent stockholders from unnecessary dilution. Indeed, Context’s stock could use a boost.

Valuation and

Share Price

Shares of

Context Therapeutics have fallen steadily since early November 2024, seemingly

triggered by the Company’s report of financial results for the third quarter

ending September 2024. The report mostly

repeated news of events announced earlier in the year; including the successful

completion of a $100 million capital raise in May 2024, use of cash for a

strategic acquisition, and management’s proclaimed cash budget adequate through

early 2027. Perhaps some traders simply

cannot read, a failing which often creates opportunity for contrarian

investors.

The steady

downbeat of share price is especially noteworthy, given that Context has in the

last year passed from the discovery stage and to the clinical stage. In May 2024, the FDA gave its go-ahead to

conduct human clinical trials of CTIM-76 and in July 2024, the Company

acquired CT-95 already approved for Phase I clinical trial. Some might disagree on the percentages, but

the U.S. Department of Health & Human Services indicates the chance of

success for a clinical stage drug improves to 54% with the advance to clinical

trial compared to 31% success rate in the earlier discovery stage.

In our view, the

Company’s shares should have reflected an increase in valuation over the

last year based on fundamental performance.

Instead, shares recently set a new 52-week low price level.

The technical

perspective is similar. Just before this

article was published the shares were reflected as oversold according to the

Commodity Channel Index (CCI) indicator as well as the Relative Strength Signal

(RSI).

Granted, there

are some obstacles to fair pricing of CNTX.

Traders should note the fairly wide bid-ask spread for the shares is

near $0.0701, or 12.7% of the bid. This

compares to an average 1.01% for Nasdaq listed stocks, which includes some of

the most liquid stocks in the U.S. Based

on trading sessions over the last six months, average volume for CNTX is near

166,000 shares, well below the volumes of most of its Nasdaq peers. Trading volume could be suppressed by the

fact that over three quarters of the outstanding common stock shares are held

by institutions that are most likely holding fast for favorable fundamental

developments. In other words, the

constructive flotation of CNTX shares much smaller than implied by insider

holdings alone.

Investors establishing

long positions might count on a ‘short squeeze’ to propel the stock higher on favorable

news. The current short interest is near

2.25 million shares or about 2.5% of outstanding shares. At current average trading volume, it would

take an estimated 14 trading sessions or three weeks to clear short interest in

CNTX.

Deals, Pacts and

Collaborations

Investors should

not overlook biotech industry news as a valuation trigger in the BS-TSE field. Just before this article was published

Bristol-Myers Squibb Company (BMY: NYSE)

announced it could shell out as much as $11 billion to BioNTech SE (BNTX: NasdaqGS) in a series of payments to get

access to BioNTech’s BNT327, a bispecific antibody that targets PD-L1 on solid tumor

cells and a protein VEGF-A found in the tumor microenvironment. Preliminary results from a Phase II trial

showed encouraging efficacy results and a manageable safety profile for BNT327,

which is currently undergoing Phase 3 clinical trials for lung cancer.

BioNTech will

receive a $1.5 billion up-front payment, which is equivalent to about 15% of

its market capitalization before the deal was announced. After the announcement BTNX soared by 20% in

early trading. Shares of Instil Bio,

Inc. (TIL: NasdaqCM) also moved higher probably

because its AXN-2510 bispecific antibody also targets PD-L1 and several VEGF

ligands.

The deal

eclipses a partnership announced just three months ago between AbbVie, Inc.

(ABBV: NYSE) and Xilio Therapeutics,

Inc. (XLO: NasdaqGS). To collaborate with Xilio, AbbVie is paying

$52 million upfront and promises another $2.1 billion in milestone payments. AbbVie had made two earlier deals in the

immunology field, but is also attracted to Xilio’s ‘masked’ T-cell engagers.

These deals shine

a spotlight on the potential in merger, acquisition or partnering as possible

routes to successful commercialization of new therapies. Earlier we made note of Context’s need to

raise capital sometime toward the end of 2026 or early 2027. However, with keen strategic interest in bispecific

antibodies and T-cell engagers, Context might collaborate with some well-financed

player.

Additional Due

Diligence

Some investors

might be put off by the fact that there are so many competitors entering the

immunological field. There are already fifty

approved monoclonal therapies, which are cloned antibodies designed to ferret

out invading pathogens. Of these, two

dozen are aimed at cancer cells. CAR

T-cell therapy uses genetically altered T-cells from the patient in an infused

treatment. Seven of these more complex

therapies have been approved by the U.S. FDA.

There are eight

bispecific T-cell engager therapies approved by the U.S. FDA beginning with

blinatumomab in 2014, followed much later by a rush of several more beginning

in 2022. Notably, only one BS-TCE has been approved for

treatment of solid tumors, ImmTax from Immunocore Holdings (IMCR: NasdaqGS).

Of course, there are more therapies in development. The attractiveness of the sector yields impressive list of large pharmaceutical companies such as AstraZeneca Plc (AZN: NYSE) as well as the presence of smaller biotechs such as Janux Therapeutics, Inc. (JANX: NasdaqGM) and Merus N.V. (MRUS: NasdaqGS). (See a longer list at the end of this article.)

Context’s

investor presentation includes a table of developers of bispecific T-cell

engagers (BS-TCEs). However, Synapse provides a background on

approved BS-TCEs and a few tidbits on strategic deals and collaborations among

top players. Synapse also offers a

summary of the scientific challenges presented by TCEs and the implications for

regulatory approval.

To get help in

sorting out who is who in the BS-TCE field, investors can also get guidance

from the Antibody Society and bcc Research, as two examples.

There is also a growing number of articles about the science of T-cells in

general and BS-TCEs in particular. The Cleveland Clinic keeps T-cells

simple while the National Library of Medicine

provides a healthy dose of scientific terms and acronyms. City of Hope and Oxford Academic get into the thick

of BS-TCE science.

Neither the author of the Small Cap

Strategist web log, Crystal Equity Research nor its affiliates have a

beneficial interest in the companies mentioned herein.

Underwriters of the Prime series may

have a beneficial interest in, serve as agents of, or act as advisors to the

companies mentioned herein.

No comments:

Post a Comment