At the most basic level all fuel cells are energy transformers, converting chemical energy in a fuel to thermal energy without combustion. Indeed, a hydrogen fuel cell could be two to three times more efficient that an internal combustion engine running on gasoline. The efficiency advantage over greenhouse gas producing engines is why hydrogen fuel cells are getting so much attention.

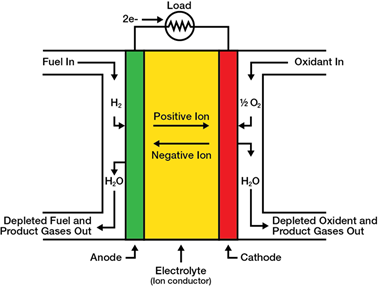

Fuel cell

function is exclusively chemical - no mechanical parts, no noise from busy motors

or moving parts and mostly importantly, no flame. Hydrogen fuel cells feature the typical

battery components - an anode and a cathode, separated by an electrolyte

for a conductor. Fuel is delivered to the

anode side and an oxidant, usually air, is delivered to the cathode. Electrons and protons from the atoms of fuel

are stripped off in the anode. Then the

electrolyte conducts the negatively charged electrons through a circuit,

generating electricity. After a round

through the circuit, the electrons recombine with the protons and oxygen from

the air in the cathode to make water molecules.

Water is the only by-product of the hydrogen fuel cell.

Source:

National Energy Technology Laboratory

The detail is

offered to demonstrate how much room there might be for innovation in the

hydrogen fuel cell. Indeed, there are dozens

of fuel cell designs. Several of the most

innovative players in the hydrogen fuel cell game have chosen a design that

uses a solid material rather than a liquid for the electrolyte component - the

solid oxide fuel cell.

Nicknamed SOFCs,

the design delivers about 60% efficiency

- i.e. that much energy stored in

the fuel is converted to electrical energy.

SOFCs operate at high temperatures

and thus do not require expensive platinum catalyst material needed in alternative

designs. The excess heat can be used in

a cogeneration scheme, providing users with another strong economic boost. Designers also have options for the form

factor, including tubular geometries or wave-like structures as well as the

conventional planar or ‘sandwich design’.

Investors can

get a bite of the SOFC promise with a stake in Bloom Energy

(BE: NYSE). Bloom’s Energy Server is a power generation

platform that demonstrates one of the other advantages of the SOFC design - flexibility

to work with a variety of fuel types, including natural gas or biogas as well

as hydrogen.

Bloom’s most

recently announced customer is Taylor Farms in California. The produce grower is vulnerable to brown-outs

and black-outs that have become typical of California’s power industry. Bloom is supplying 6.0 megawatts of fuel cells

for a private microgrid for its San Juan Bautista facility that will allow

Taylor to disconnect entirely from the utility grid. The system will also include 2.0 megawatts of

solar power and a 2.0 megawatt battery array.

In addition to greater reliability, Taylor Farms will get to claim a

low-carbon production process for its salad fixings and other produce.

Bloom is

certainly not on a mission against electric utilities. The company recently partnered with Xcel Energy (XEL:

Nasdaq) to install a hydrogen electrolyzer at Xcel’s

Prairie Island nuclear power plant. The

heat and steam produced at the Prairie Island facility will feed the

electrolyzer to produce zero-carbon hydrogen. A 240-kilowatt demonstration is planned with

construction scheduled for late 2023 and commissioning in early 2024. Xcel chose Bloom’s SOFC design over competing

PEM (polymer electrolyte membrane and alkaline designs.

In the twelve

months ending June 2022, Bloom recorded $994 million in total sales. The company has yet to achieve profitability

as direct costs and operating expenses still loom large against revenue. The company used $123.9 million in cash resources

in the same twelve-month period. No one

on the Bloom team is likely worried about the cash drain, given a plump bank

balance of $396 million at the end of June 2022. A strong cash balance is also needed given Bloom’s

leveraged balance sheet. At the end of

June 2022, the company had $1.1 billion in long-term debt. Leverage leaves the company’s balance sheet

with net negative tangible book value.

With a balance

sheet revealing a bit of risk, it is not surprising that the stock is somewhat

volatile. The company’s stock has a beta

measure of 3.00. The stock is also a bit

pricey, trading at 3.0 times sales. Of

course, the price to earnings ratio is negative and a shareholder deficit yields

no valuation measure. Any one

considering BE should have a long-term investment horizon and a tolerance for

price volatility. The price may be worth

it to get a stake in a company that has established a foothold in the hydrogen

power market.

Neither the author of the Small Cap Strategist web log,

Crystal Equity Research nor its affiliates have a beneficial interest in the

companies mentioned herein.

No comments:

Post a Comment