The big islands like Aruba are not the only ones to need energy alternatives. Antigua and Barbuda are among the leeward islands in the West Indies, boasting white beaches, lush coral reefs and favorable sailing weather. Most of the 80,000 people who live in on the two islands are involved with entertaining visitors to the tropical paradise. Like all the other islands in the Caribbean Antigua and Barbuda are heavily reliant on imported fossil fuel to keep the island nation’s tourist trade humming.

In early 2019, the government of Antigua and Barbuda signed a memorandum of understanding with Sweden’s Minesto AB (7MN: FRA) to study an alternative tidal power technology. The United Nations is facilitating the study.

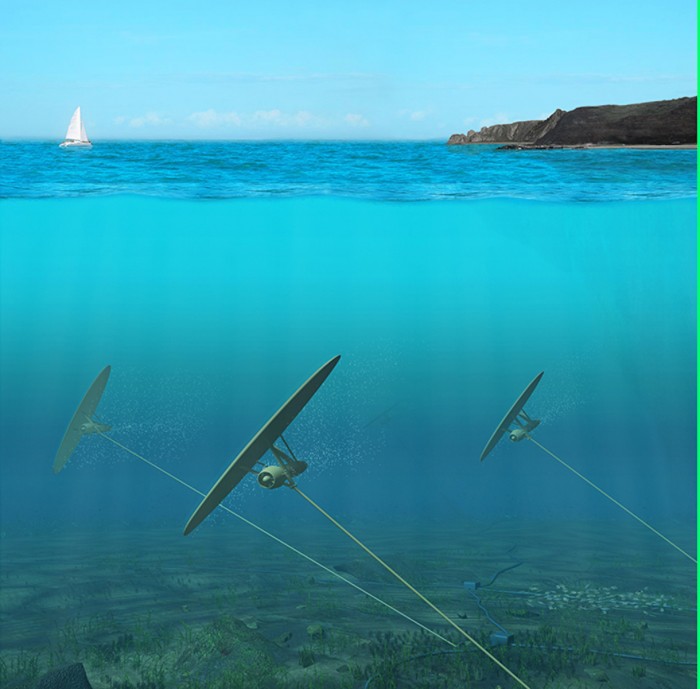

Minesto's tidal power solution called Deep Green takes a lesson from wind power. Instead of wind its is ocean current that drives the turbine. Built like a 'wing', Deep Green 'flies' under the water in an eight-shaped trajectory. The device is actually moving at a faster speed than the underwater current. This makes it possible to generate significant amounts of energy even from slow moving tidal currents. Consequently, Deep Green can be deployed in less hostile ocean environments, unlike some other tidal power solutions that must seek harsher, fast current location and then are bedeviled by maintenance issues.

Minesto has yet

to generate revenue from their Deep Green

tidal energy solution. As a consequence,

the company used Krona 33.6 million (US$3.5 million) in cash resources to

support operations over the last year. At the end of December 2018, the company

had Krona 2.9 million (US$300,000). That

might seem a bit alarming, but it is important to note that Minesto also has

Krona 49.1 million (US$5.1 million) in current receivables on its books.

The company remains

heavily reliant on successive capital raises to keep the doors open. Sweden’s private equity firm BGA Invest

has been an investor since 2010.

Additionally, money has come from the Swedish Energy Agency

and the Carbon Trust. The company’s last major capital raise its

initial public offering in 2015, when Euro 14 million (US$15.5 million) in

common stock was sold.

It is not clear

when Deep Green will gain traction

commercially. Besides the Caribbean,

Minesto is working on potential projects in Taiwan and the Faroe Islands in the

North Atlantic.

Past deployments

provide the data to convince prospective customers of Deep Green’s merits. A prototype of the device was deployed in

2013 in Northern Ireland. The project of

the coast of Strangfold Lough has provided ample evidence that the device

works. In 2018, a commercial scale

system was deployed in Holyhead Deep, Wales, providing final verification of

the system’s potential. In early August

2019, the company reported the resumption of sea tests in Holyhead Deep to

gather long-term data that could help with optimization and cost reduction. Management has indicated that changes in

installation protocols alone have yielded improvements to capacity at a lower

cost level.

Minesto is a

highly speculative investment, but among the few public companies that provide

a stake in the nascent ocean power sector.

The novel technology helps mitigate at least of one of the greatest risks

tidal and wave power developers face

- capital loss due to the hostile

ocean environment.

Neither the author of the Small Cap Strategist web

log, Crystal Equity Research nor its affiliates have a beneficial interest in

the companies mentioned herein.

No comments:

Post a Comment