The post “Integrated Graphene Producers”

featured several graphene producers with novel business models that marry

captive graphite sources to the technology and knowhow to produce

graphene. These are not the only

graphite producers. Although not as

elegant as graphene with its svelte single-atom profile, the market for graphite

has its appeal as well. Graphite has

been a staple in steel industry crucibles, foundry molds and automobile brake

linings. These days graphite has moved

into another even more important place in cars

- lithium ion batteries that make

electric vehicles viable as replacements for gas guzzling cars and trucks.

Spherical

graphite is especially desirable because the graphite anodes hold up well

against the lithium electrolyte in repeated charge and discharge cycles. Both coated and coated spherical graphite has

experienced a surge in demand.

In 2017, the

lithium ion battery market consumed 105,000 metric tons of graphite -

60,000 natural coated spherical purified graphite and 45,000 synthetic graphite. Investors can expect these numbers to climb dramatically to keep up with the battery market. MarketResearch, an industry

research firm, estimates the lithium ion battery market will grow by 16.5% annually through 2024. Those big numbers have quite a few miners

reaching for picks and axes. How many will gain a foothold in this big,

fast growing graphite market?

|

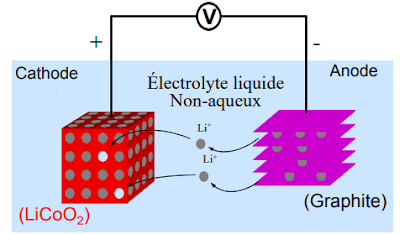

| Lithium Ion Battery Diagram |

The fifteen natural graphite resource developers listed below all have one thing in common - no revenue. Even with the best of graphite resources under their control, management has considerable work ahead to bring the resource to market. The reality of mineral resource exploitation is marked by high capital costs and pinched operating margins. Several of the graphite developers have made plans to integrate forward into the hottest segment of the market - battery-grade graphite. According to Industrial Minerals, spherical graphite suitable for lithium ion battery anodes is priced in a range of $2,700 to $2,800 per metric ton in China where many battery manufacturers are located. This compares quite well to the range of about $655 to $790 per metric ton for flake graphite concentrate.

Yankee Graphite

The integration

strategy has sent the sector into a frenzy of activity to prove their graphite

meets expectations of battery manufacturers.

The only graphite deposit in the U.S. mainland is under development by Westwater

Resources (WWR: Nasdaq). Historically, known as uranium producers,

Westwater made a critical decision to diversify into other energy materials

with strategic investments in lithium exploration licenses in Utah and Nevada. Then in April 2018, Westwater acquired

Alabama Graphite with graphite development projects in Coosa and Bama Counties

in Alabama. The graphite deposits are

well documented and have a history of exploitation when the U.S. was still in

graphite game in the 1940s.

Trying to get

back in the game with a competitive battery-grade material, Westwater recently

released new data from independent tests.

The company puts low volumes of its natural flake graphite through a

series of refinement steps - purifying, micronizing, shaped into spheres

and then coated with carbon powder. The

most recent tests found Westwater’s Coated

Spherical Purified Graphite or ULTRA-CSPG held up better than comparable

graphite from Chinese sources in long-term cycling tests.

Although no

long-term, high-volume off-take agreement is in place, Westwater has customer

interest for one of its basic battery materials

- Purified Micronized Graphite or PMG. The company’s PMG has also held up well under independent tests that found

exceptional results for performance enhancement in lead acid battery

cells. An undisclosed lead acid battery

manufacture has declared interest in commercial volumes beginning in 2021, and

continues early testing.

|

SELECTED GRAPHITE DEVELOPERS

|

||||

|

Company

Name

|

SYM

|

Price

|

Mkt Cap

|

Revenue

|

|

American Graphite Tech.

|

AGIN: Nasdaq

|

$0.004

|

$365K

|

-0-

|

|

Eagle Graphite, Inc.

|

EGA: TSX-V

|

$0.067

|

$2.6M

|

-0-

|

|

Focus Graphite, Inc.

|

FMS: TSX-V

|

$0.26

|

$9.8M

|

-0-

|

|

Graphite One, Inc.

|

GPH: TXS-V

|

$0.28

|

$9.4M

|

-0-

|

|

Kibaran Resources Ltd.

|

KNL: ASX

|

$0.09

|

$25.2M

|

-0-

|

|

Leading Edge Materials

Corp.

|

NGRC: Nsdq

|

$0.04

|

$6.8M

|

-0-

|

|

Lomiko Metals, Inc.

|

LMR: TXS-V

|

$0.041

|

$3.1M

|

-0-

|

|

Mason Graphite

|

LLG: TSX-V

|

$0.29

|

$39.8M

|

-0-

|

|

National Graphite Corp.

|

NGRC: Nsdq

|

$0.044

|

$6.8M

|

-0-

|

|

NextSource Materials,

Inc.

|

NEXT: TSX

|

$0.075

|

$38.0M

|

-0-

|

|

Northern Graphite Corp.

|

NGC: TSX-V

|

$0.12

|

$7.8M

|

-0-

|

|

Nouveau Monde Ltd.

|

NOU: TSX-V

|

$0.18

|

$31.4M

|

-0-

|

|

NovoCarbon (Great Lakes)

|

GLK: TSX-V

|

$0.025

|

$3.3M

|

-0-

|

|

Strike Resources Ltd.

|

SRK: ASX

|

$0.061

|

$8.9M

|

-0-

|

|

Valerra Resource Corp.

|

VQA: TSX-V

|

$0.02

|

$1.5M

|

-0-

|

|

Westwater Resources, Inc.

|

WWR: Nasdaq

|

$0.18

|

$13.7M

|

-0-

|

|

|

|

|

|

|

|

US Dollars

|

||||

Canadian

Connection

Like performance

test results, customer relationships are critical stepping stones for graphite

developers. In June 2018, Northern

Graphite (NGC: TSX-V)

announced a memorandum of understanding with a European trading company to sell

100% of the output from Northern’s Bisset Creek resources in Ontario, Canada. China-based manufacturers are the intended

end-users. Northern management is using

the arrangement as leverage with prospective investors to finance mine

infrastructure and processing equipment.

Capital costs are expected to exceed CA$145 million.

Northern claims

a proprietary purification technology the company intends to use to upgrade its

graphite output. Its Bissett Creek deposit yields primarily

large flake graphite that requires considerable shaping to reach the spherical

shape that is best suited for lithium ion batteries. Northern has so far not been clear on whether

the European trading company that has pledged to sell the Bisset Creek

production is prepared to sell the high-margin purified material or is aiming

for lower end graphite concentrate.

Tanzania

Kibaran

Resources (KNL: ASX) is focused on the Epanko deposit in Tanzania in East Africa. The company recently raised AU$2.2 million

through a AU$1.0 share purchase plan for existing shareholders and a AU$1.2

million private placement. The capital

serves as a strong vote of confidence in the company’s plan to convert the

Epanko resource into battery-grade graphite.

Shareholders may have been inspired by recently announced test results

from European customers.

Kibaran calls its purification process EcoGraf and claims it can produce a

range of high-purity graphite material.

The recent customer tests were completed using spherical graphite

produced form Kibaran’s Epanko flake graphite.

Kibaran recently commissioned a new batch plant in Germany to facilitate

further customer testing.

For those investors who have more of an appetite for

revenue and profits, there are a number of graphite producers that have already

reached the market. The next post

features these successes and explores valuation for graphite production.

Neither the author of the Small Cap Strategist web

log, Crystal Equity Research nor its affiliates have a beneficial interest in

the companies mentioned herein. Crystal Equity Research has a Speculative Buy

rating on the shares of Westwater Resources, Inc. (WWR: Nasdaq) through its CER Reports series.

No comments:

Post a Comment