In this post we look at two more companies bringing

efficiency to the water industry.

AI for Water

Treatment

Pluto AI, Inc. likes is a self-styled ‘problem solver.’ The company’s engineers have developed an

intelligent platform for water, wastewater and industrial treatment

plants. The platform uses artificial

intelligence algorithms to analyze data from plant computer systems. It is more than just data from water meters,

there are also event logs and SCADA (supervisory control and data

acquisition). Pluto’s system could be

characterized as deep machine learning.

Platform users can see all of the plants assets and receive

recommendations generated by the system algorithms. Pluto is currently looking for beta partners

to test their intelligent platform.

In early 2017,

Pluto AI raised $2.1 million from a group of venture capital firms, including

Refactor Capital, Unshackled Ventures, Comet Labs and Fall Line Capital. If the company is successful in finding beta

partners, more likely than not Pluto will need more capital to move on to the

next steps of commercializing and marketing it product.

Big Water Data

There is

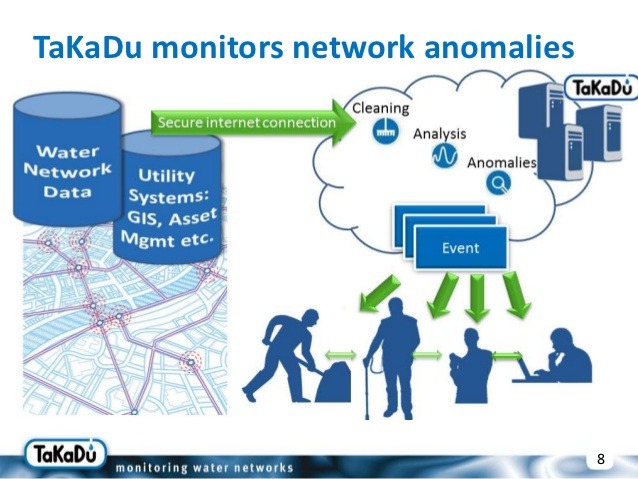

competition for Pluto AI in the water market in particular. Based in Israel, TaKaDu is a software

developer that wants to take the water industry into ‘the cloud.’ TaKaDu has put together a cloud-based service

for water utilities to detect, analyze and manage water leaks, burst pipes or

other system issues. Plenty of other

systems do the same, but TaKaDu goes one step further to help utilities

prioritize the response for the most savings and revenue. The company claims its system can reduce

water losses by as much as 30% per year and average repair cycles by 60%. Unitywater just renewed its service contract

for another three years beginning August 2017.

There might be

something to TaKaDu’s boasts. It is has

customers in several continents.

TaKaDu’s corporate website features several customers that attribute

their successes to TaKaDu. For example,

Unitywater in Queensland, Australia credits the TaKaDu solution with helping to

stem water losses by identifying leaks.

After a 12-month trial Unitywater deployed the system

network wide in July 2014, not only for leaks, but for other types of failures

such as telemetry and meter malfunctions.

TaKaDu has caught the attention of some big names in water, including

the Veolia Group. The TaKaDu system has

been deployed since October 2016, at Apa Nova Bucharest, Romania’s

largest water utility and a member of the Veolia Group.

TaKaDu stands

out among the other early stage innovators, but not necessarily for its water

system solutions. The company has raised

more money than most - $13.9 million and counting. TaKaDu appears to have advanced to a later

stage of market penetration across multiple continents. That requires an extra round or two to

support sophisticated marketing strategies and multiple sales teams. Venture capital firms with some

sophistication of their own signed on the for the most recent financing round

in October 2013, including Emerald Technology Ventures, ABB Technology Ventures,

Giza Venture Capital and Gemini Israel Ventures. Representatives of all four firms have been

given seats on TaKaDu’s board of directors.

With the considerable influence that board membership offers, these

venture firms will most likely be looking for the next good step up in

valuation and a chance to harvest returns.

This might mean an initial public offering of common stock or sale to a

larger public company. Either way

minority investors can ultimately get involved, even if only indirectly.

Neither the author of the Small Cap Strategist web

log, Crystal Equity Research nor its affiliates have a beneficial interest in

the companies mentioned herein.

No comments:

Post a Comment