Batteries

are becoming an enabler of renewable energy technology adoption. The electric car has become widely accepted

as an alternative to cars powered by fossil fuel combustion engines. This has largely been possible because advances

in batteries have made it possible to store enough energy to power a car for

extended time periods or mileage.

Intermittent power generation sources such as solar and wind are also

highly dependent upon storage solutions.

We return to the battery technology topic frequently because it could

offer strong returns for renewable energy investors. It is not just the battery makers. Producers of the components and materials for

batteries are also fair game.

Over the

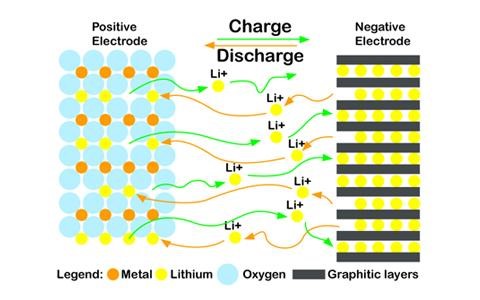

past two years, leadership of Alabama Graphite (CSPGF: OTC/QB) has delivered a steady drumbeat of accomplishment. The Company plans to exploit a natural flake

graphite resource in south-central Alabama and use a proprietary refinement

process to deliver an ultra-high purity graphite material to the U.S. domestic

lithium ion battery market.

AGC’s proprietary low-temperature process has been proven successful in producing refined graphite materials that exceed quality and performance requirements of battery manufacturers. In April 2017, the most recent results from a series of independent tests confirmed 99.9999% carbon purity in a multi-kilogram sample of the Company’s primary product, Coated Spherical Purified Graphite (CSPG).

Another

list is growing of established battery manufacturers and technology developers

conducting qualifications tests using the Company’s CSPG and a

by-product Purified Micronized Graphite (PMG). In early May 2017, Physical Sciences, an

approved government contractor, declared CSPG a “candidate for use in

Department of Defense and Department of Energy funded projects.” Physical Sciences is among a dozen defense

contractors, battery manufacturers and technology developers that have received

materials samples from AGC.

In our

view, the stock price does not reflect fundamental accomplishments, leaving the

stock deeply undervalued. Granted,

inadequate capital resources present a critical obstacle to reach the market

with finished products. The Company

recently raised CDN$1.3 million (US$981,240) that will be used to carry out the

next product and business development steps.

The Company has begun early production of an inventory of 120 kilograms

of CSPG and 35 kilograms of PMG for shipment to prospective

customers for testing and qualification trials.

We believe the recent financing can support this effort but additional

potentially dilutive financing may be needed for subsequent steps such as

permitting.

We

believe each fresh test result and each new advance with potential customers

confirms the quality, performance and marketability of the Company’s CPSG

for lithium ion batteries in particular.

In our view, the stock should reflect a higher probability that AGC can

surmount its business challenges to successfully bring its graphite resource to

market as a high-value added spherical graphite material.

In our view, the stock is undervalued and is an interesting target for risk tolerant investors. We expect to see a continuing stream of announcements from the Company related to quality and performance testing at AGC’s own laboratory as well as from third parties. Results are expected in the near-term from qualification trials by prospective customers that received CSPG and PMG samples earlier in 2017. Each successive news release could elevate investor confidence that AGC’s management team is executing on the plan to enter the U.S. domestic market with an ultra-high purity graphite material suitable for use lithium ion batteries.

Neither the author of the Small Cap Strategist web

log, Crystal Equity Research nor its affiliates have a beneficial interest in

the companies mentioned herein. CSPGF is

the subject of research coverage by Crystal Equity Research under the Focus

Report series for sponsored research coverage.

No comments:

Post a Comment