A series on

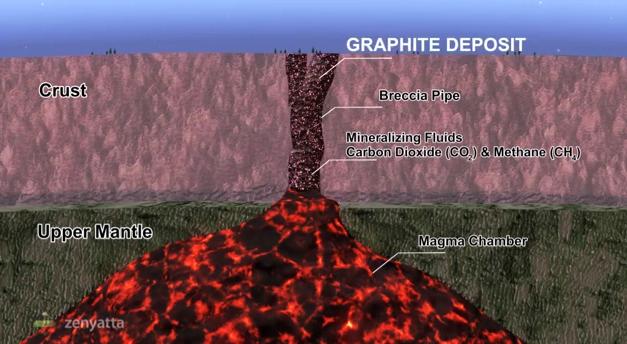

graphite resource development must include Zenyatta Ventures Ltd. (ZEN:

TSX-V), which has zeroed in on a graphite deposit

in northern Ontario Province. Called the

Albany Graphite Deposit, the resource is unusual in its volcanic origins. A preliminary economic assessment was

published in January 2014, citing 25.1 million metric tons of graphite resource

with another 20.1 million metric tons inferred.

Early tests

suggest the graphite is quite high in purity and is particularly suitable to

the company’s proprietary concentration process. Zenyatta plans to deploy a process using

sodium hydroxide instead of environmentally unfriendly acids. Bench tests using this purification method on

graphite from the Albany deposit have achieved carbon purity as high as

99.9%.

Zenyatta has

much work to do to make its graphite plans into reality. Adequate capital is an obstacle. The company recently raised CDN$2.9 million

through a rights offering. Shareholders

subscribed to 3.9 million shares at CDN$0.75 per share, bringing total shares

outstanding to 62.9 million. Management

has a long list of things to do with the proceeds. Top of the list is the production of purified

graphite samples to give potential customers for testing. Of course, there is more work to optimize the

production process at scale.

More capital

will be required to bring graphite ore from the Albany Deposit to market. Based on the success of the rights offering, Zenyatta’s current shareholders clearly believe this

goal can be achieved. It seems likely

management can get additional investors to drink the same kool-aid. The preliminary engineering assessment cited

capital costs near US$411.4 million for construction of the mine and production

infrastructure. The build-out is

expected to take at least two years.

Neither the author of the Small Cap Strategist web

log, Crystal Equity Research nor its affiliates have a beneficial interest in

the companies mentioned herein.

No comments:

Post a Comment