PRIME SERIES

Clearmind Medicine

(CMND) is a clinical stage pharmaceutical company with the promising CMND-100

candidate at the front end of its pipeline. CMND-100 is based on the psychoactive compound

MEAI, shorthand for the synthetic molecule 5-MEthoxy-2-AminoIndine. The Company purchased the compound in 2021,

and has since completed several pre-clinical studies in animals to establish safety

and metabolic profiles.

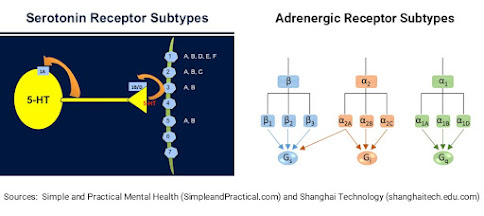

One of the pre-clinical

studies tested MEAI as a curb for alcohol cravings in ‘binge drinking’ mice. The MEAI compound interacts with central nervous

system elements, specifically serotonergic receptors 5-HT1A and 5-HT2B as well

as adrenergic receptors α2A, α2B and α2C. The receptor 5-HT1A is particularly important

in alcohol dependence, so agonists of this receptor could help in reducing

alcohol intake. Importantly, MEAI may

have application for other binge-like diseases such as cocaine abuse and overeating.

Results for

early tests have been promising, prompting the Company to make plans for human

clinical trials. In early 2023, an Investigational

New Drug (IND) application was submitted to the U.S. Federal Drug

Administration (FDA) for the first human clinical trials of MEAI as CMND-100

aimed at patients with Alcohol Abuse Disorder or AUD.

The U.S. trials will be conducted at the Yale School of Medicine’s Department of Psychiatry and Johns Hopkins University School of Medicine. A similar application has been submitted to Israel’s Pharmaceutical Division of the Ministry of Health, which regulates the drug registration process in that country.

Speculative

and Compelling

Shares of Clearmind

Medicine offer a stake in a promising compound aimed at diseases with

increasing incidence and few effective treatments. The bull case for the stock balances the

risks of an early-stage company with the opportunity of large, but underserved patient

groups.

In this author’s

view, the stock is best suited for investors with a palate for the unique risks

inherent in pharmaceutical development

- an average 10% probability for

successful completion of clinical trials and regulatory approval of newly

discovered therapeutic compounds. Yet,

once the details are hammered out, regulatory approval of CMND-100 could

open the door to a market primed for effective therapies of binge behavior. As is discussed below, sales and profit

potential in the AUD market alone is compelling.

Taking psychoactive

therapies seriously

Mention psychedelic

drugs and many people might think first of LSD and the drug fueled 1960’s and

1970’s -

not a therapy to be taken seriously by the medical community. It is time to recalibrate! Psychoactive compounds may have effective

properties for the treatment of numerous medical conditions.

Indeed, the U.S.

Federal Drug Administration has taken note and is ready to entertain regulatory

petitions for potential drug products.

In August 2023, the FDA issued draft guidance for drug developers

entitled “Psychedelic

Drugs: Considerations for Clinical

Investigations – Guidance for Industry”.

The FDA followed this publication with a virtual public workshop

entitled “Advancing

Psychedelic Clinical Study Design” for researchers and industry.

Perhaps Clearmind

scientists could have benefited from the new guidance if the FDA had published

it a few months earlier. Nonetheless, in

January 2024, a Type A meeting with Clearmind scientists and FDA

representatives has apparently tightened up and refined the Company’s IND application

to proceed with tests of its CMND-100 in humans. In recent conversations with this author, Clearmind

management expressed confidence in winning the FDA go-ahead for a Phase I clinical

trial in 2024.

Lucrative

target market for profit….or critical community service

The poignant difficulties

experienced by AUD suffers in terms of disruption in relationships, loss of

employment and costs of illness might be enough to attract some scientists to work

on the problem. However, for

profit-oriented companies and their investors, the market presents a particularly

lucrative investment opportunity.

Alcohol abuse is

among the most frustrating and costly diseases suffered by humans. The National

Center for Drug Abuse Statistics (NCDAS) estimates AUD along with alcoholism

kills over three million people each year, representing 6% of global deaths. Additionally, the financial burden of alcohol

misuse is enormous. Indeed, the UNC

School of Medicine Bowles Center for Alcohol Studies estimates over 15% of

the entire national health care budget in the U.S. is spent on treating

conditions related to substance abuse, including alcohol. The Centers

for Disease Control and Prevention takes a view from a higher vantage

point, estimating excessive alcohol use results in an economic loss of $249

billion annually from the U.S. economy alone.

With an economic

significance of such import, it follows that the market opportunity for AUD solutions

is large and growing. Future

Market Insights, an industry research firm, estimates the global AUD

treatment market generated $700 million in value in 2023. Within the next ten years the firm estimates

the rising incidence of AUD and binge drinking could drive the market value to

$1.3 billion by 2033.

Competitors

and Peers

Presently there

are a handful of medical treatments for AUD.

Despite long-time approval by the U.S. FDA, none have captured dominant market

share. The segment may have also lost a participant.

Sanofi announced

in April 2023, it would be taking its Antabuse (disulfiram) off the market citing

supply chain issues. However, thin margins

on a low-priced product probably also played a role. Disulfiram stops the body from breaking down

ethanol in alcoholic beverages, leading to such severe headaches, nausea and

vomiting. The effects are so severe patients

are dissuaded from consuming alcohol. The

fact that many patients are disappointed in Sanofi’s decision reveals the lengths

to which AUD suffers will go to get relief.

Notably, two companies

have naltrexone-based therapies on the market.

Originally intended for emergency treatment of opioid overdose, naltrexone

has its own side effects, such as stomach cramping, anxiety, headache and trouble

sleeping. Naltrexone packaging also carries

the hated FDA black box with a warning for potential liver damage if taken at

doses higher than recommended. Despite

the side effects, naltrexone branded as Vivitrol in 2023 earned an estimated $410

million in annual sales for its owner Alkermes plc (ALKS).

|

Regulatory

Approved Therapies for AUD |

|||

|

Compound Name |

Brand Name |

FDA Approval |

Manufacturers |

|

Disulfiram |

Antabuse |

1949 |

Sanofi (SNY: NYSE) |

|

Naltrexone |

ReVia |

1994 |

Teva Pharma (TEVA: NYSE) |

|

Acamprosate |

Campral |

2004 |

Forest Sub of Allergan (AGN: NYSE) |

|

Naltrexone |

Vivitrol |

2006 |

Alkermes, plc

(ALKS: NYSE) |

There are other

developmental stage companies vying for the next FDA approved AUD

treatment. For example, Adial Pharmaceuticals

(ADIL) is working on AD04, a serotonin-3 antagonist targeted at certain genetically

qualified patients suffering from AUD. Currently,

the company is planning two Phase III trials to satisfy regulatory applications

in both the U.S. and European Union.

Bootstrapping

to Higher Valuation

The aspirations

of Clearmind’s scientists are all just talk without adequate capital to complete

required development work and clinical trials.

In January 2024, the Company raised a total of $2.4 million in new capital

through the sale of 1.5 million shares of common stock and another 1.5 million warrants.

After the recent

capital raise capital resources are estimated near $6.05 million. (Cash at the end of July 2023: $3.85M + Exercise of warrants: $3.50M + Offering proceeds: $2.4M – Estimated cash used to support

operations through Jan. 2024: $3.70M) Management has guided for current cash reserves

closer to double digits, suggesting a significant reduction in cash usage in

the last six months while the Company has hammered out details for its IND application

to the U.S. FDA.

In a recent

conversation with this author, the Clearmind team expressed confidence in having

the resources to complete planned clinical trials for CMND-100. This would be an important achievement, given

that management would have data from Phase I clinical trials to cite if additional

capital is needed for the next step. The

Company can thus artfully accomplish what sometimes eludes developmental stage

companies: minimizing dilution by raising

only just enough capital to achieve measurable results and then using those

results to bootstrap to a higher valuation in the next financing effort.

Value

drivers…multiple treatment applications

This article has

focused on the AUD treatment application.

However, that might be selling the Company short on the potential in CMND-100.

The MEAI compound may have applications for

obesity and drug addiction as well.

Clearmind recently

cooperated with research scientists at the Bar-Ilan University in Israel in

conducting pre-clinical trials of the Company MEAI molecule in animals

conditioned with cocaine. The trial

results suggested MEAI could be helpful in reducing cravings and altering

behaviors. Importantly, the trials

established the MEAI compound is not itself addictive. Clearmind has a long-term license agreement

with BIRAD, the university’s research and development arm, to use a joint

patent for cocaine treatment.

Additionally,

Clearmind is collaborating with SciSparc Ltd. (SPRC), a clinical-stage

pharmaceutical company focused on disorders of the central nervous system. The SciSparc relationship is wide-reaching,

anticipating therapeutic applications for a lengthy list of mental health disorders

in addition to binge-like and addiction diseases.

Clearmind has

already filed six provisional patent applications with the U.S. Patent and

Trademark Office for combinations of psychoactive compounds using the Company’s

MEAI molecule alone as well as in combination with SciSparc’s proprietary

anti-inflamatory compound palmitoylethanolamide (PEA).

In November

2023, the partners announced results from a pre-clinical trial aimed at determining

optimal dosage of the MEAI-PEA combination.

The animals in the trial were observed for metabolic factors such as fat

oxidation, weight loss and reduced appetite.

The mice showed high tolerance at all dosage levels, reduction in food

consumption and improvement in fat oxidation.

Clearmind leadership thinks the study is encouraging for use of the MEAI

compound for obesity and metabolic disorders with the results supporting

further study with animals and eventually humans.

Clearmind has a growing

portfolio of patent protected intellectual property - 27

granted patents in the U.S., Europe and China with 24 patent applications

pending. Applications and awarded

patents cover both method of use and composition of matter, giving the Company

the means to prevent competitors from elbowing in with a competing MEAI

compound or from imitating the Company’s proprietary chemical mixtures.

Back of envelope

intrinsic value

It is possible

to value Clearmind’s entire patent portfolio, estimating sales and earnings

potential for each of the protected compounds.

To reduce the number of assumptions to a more manageable level, a valuation

exercise was undertaken based only at the Company’s lead candidate and primary

target application, CMND-100 as a treatment for AUD.

The preferred approach

for valuing pharmaceutical companies is the discounted cash flow method. Industry averages for an early-stage companies

were used for the critical assumptions.

In this calculation, the discount rate is used primarily to reflect the

time value of money. Additionally, estimated

cash flows were adjusted to reflect business perils, i.e. the possibility of

failure at the principal development stages.

(Key assumptions and data points are detailed below.)

The exercise

found a risk adjusted intrinsic value of $4.78 per share for Clearmind, almost four

times the current stock price. Aside

from the effects of one assumption or another in the final outcome of the valuation

exercise, the difference between market and estimated stock value is probably

large due to investors’ view on execution risk.

Much

potential, many possible stumbling blocks

And pre-clinical

trials have demonstrated its principal therapy CNMD-100 based on the psychoactive

compound MEIA shows promise as a safe treatment for binge drinking. Nonetheless, there is still plenty of

opportunity for the Company to stub its corporate toe.

Successful

pre-clinical trials do not guarantee smooth sailing in human clinical

trials. The Company has lined up research

partners at ‘blue ribbon’ universities, but even if execution is perfect, the

MEIA compound could fall short of expectations as the Phase I trials unfold.

Clearmind has established

at least two strong development partnerships, one of which is with SciSparc,

another public pharmaceutical developer with complementary intellectual

property. It is notable that Clearmind

Medicine’s chief executive officer, Dr. Adi Zuloff-shani, is also the lead

science officer at SciSparc Ltd. So far,

the dual role has created some efficiency for Clearmind as in her role at SciSparc

Zuloff-Shani has already completed some required steps in Clearmind’s

development agenda. For example, qualification

of manufacturers for active ingredients is common to both firms. However, in the future potential conflicts

could arise as the two companies more forward to more advanced development work.

The FDA’s recently

issued guidance for psychedelic compound development has also helped shine a

bright light on the therapeutic value of such compounds. Certainly, the FDA’s initiative is a plus for

CNMD shareholders, but there is still room for confusion or misstep. The FDA is still perfecting it position vis-à-vis

psychoactive compounds and could change its suggested plan of action to the

detriment of development projects already underway at Clearmind.

Conclusion

Besides new fortifying

financial resources, the Company’s recent capital raise helped elevate Clearmind’s

visibility in the pharmaceutical sector as a developer with the capacity to

deliver favorable early-stage clinical trial results. In the current year, the Company’s principal

compound CNMD-100 is likely to begin dosing and safety trials with

humans suffering from alcohol addiction.

Investors with an extended investment horizon and the tolerance for

significant risk may find this inflection point is a compelling opportunity for

a stake in a

·

potentially undervalued company

with a

·

promising compound CMND-100 aimed

at a

·

large and growing market for

alcohol dependence treatment.

Neither the author of the Small Cap

Strategist web log, Crystal Equity Research nor its affiliates have a

beneficial interest in the companies mentioned herein.

Underwriters of the Prime series may

have a beneficial interest in, serve as agents of, or act as advisors to the

companies mentioned herein.

Valuation

Assumptions

Commercial Stage: Model Year 6

AUD market value: current $700 million rising to $1.2 billion in Year 6

Market share: 10%

Cash earnings margin: 8%

Commercial stage growth rate: 10%

Cost of capital: 18%

Cash flow discount rate: 11%

Risk Adjustments: Phase I - 63%,

Phase II - 58%, Phase III - 85%

Commercial stage balance sheet: No

cash, no debt

Cash reinvestment in commercial stage: None

Current shares outstanding: 3.2

million

Risk adjusted estimated net present value: $15.29 million

Risk adjusted intrinsic value per share: $4.78

No comments:

Post a Comment