The current

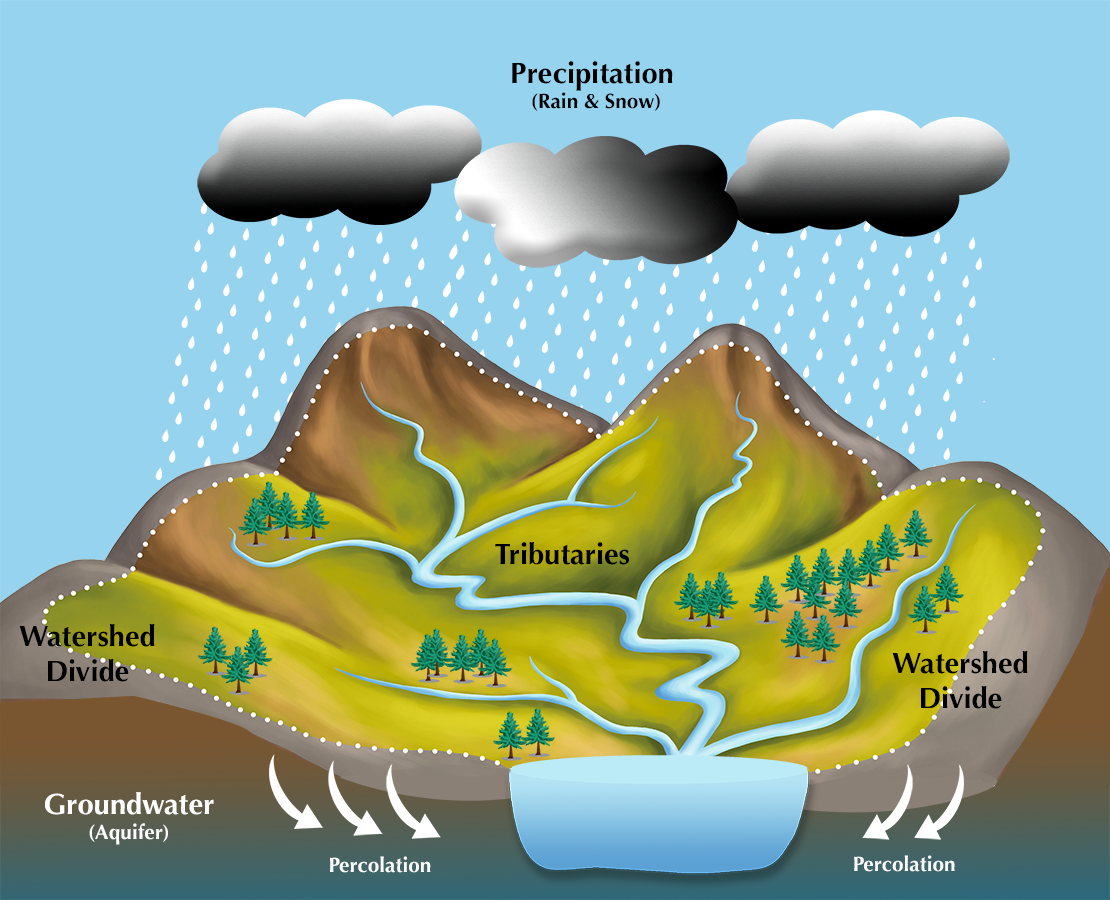

series on water supply in Latin America closes with a note on watersheds. These large expanses of land are laced with

streams and rivers draining into a even larger rivers, lakes or even an ocean. The Mississippi River and Amazon River

watersheds are so enormous they can be seen from outer space. Watersheds are the source of all the clean

water we use. The complex geographies

soak up rainwater and snow melt, collect and store the fresh water. Microbes within the soil and rocks filter and

restore the water to drinkable quality.

Unfortunately,

wastes originating from human activity often mix in with the run-off and so

severely contaminate the waterways, the natural mechanisms are overwhelmed. Pollution is linked to the formation of large

dead zones with little or no oxygen in rivers, streams and lakes. Toxic stew can even end up in ground

water.

Corporate stewardship

of watersheds is vital to the rehabilitation and maintenance of the world’s fresh

water supply. Business models that include

sustainable resource use are most likely to deliver long-term earnings. Investors

would do well to note which companies make clean water a priority. Four very different companies are reviewed

here.

Since the

adoption of the most recent version of the International Organization for

Standardization ISO 14001 in 2015, companies have paid ever more attention to the

environment. United Parcel

Service (UPS: NYSE)

is an adherent to ISO 14001, that guides efficient use of resources and

reduction of waste. As a logistics and

shipping company, UPS is more likely to be associated with greenhouse gas

emissions from its large fleet of delivery trucks and aircraft. However, at a local level UPS is attempting

be a part of the solution as well. UPS

is one of the corporate sponsors of the Watershed Management Conference

held annually in May.

Since the

adoption of the most recent version of the International Organization for

Standardization ISO 14001 in 2015, companies have paid ever more attention to the

environment. United Parcel

Service (UPS: NYSE)

is an adherent to ISO 14001, that guides efficient use of resources and

reduction of waste. As a logistics and

shipping company, UPS is more likely to be associated with greenhouse gas

emissions from its large fleet of delivery trucks and aircraft. However, at a local level UPS is attempting

be a part of the solution as well. UPS

is one of the corporate sponsors of the Watershed Management Conference

held annually in May.

A large cap

company, UPS shares are no play on altruism. The $5 billion in net income UPS operations earned

in the most recently reported twelve months, came from driving trucks and

delivering packages. That said, the mechanisms are clearly in place

in the UPS business model and management culture to conserve resources. A multiple of 14.6 times 2020 earnings and a

forward dividend yield of 3.2% might make the trucks more appealing.

Enel Green Power

of the electric and gas utility Enel SpA (ENEL: MI

or ENLAY: OTC/PK) is

also a sponsor of watershed clean-up activities. The U.S. subsidiary is on board with the Merrimack River

Watershed Council, which advocates and promotes responsible

use of waters in the Merrimack River in New Hampshire and Massachusetts. Of course, this is but a token expenditure

for Enel, which records billions in revenue and earnings from the sale of

electricity and gas around the world. Enel

has been building its environmental stewardship credentials over the years.

Enel Green Power is the group’s renewable energy and power production

subsidiary. That means a portion of the

company’s dividend is coming from green energy.

With a current dividend yield of 4.6% that has to be appealing for

investors who are willing to take a stake in a foreign stock.

Jam and water may

not seem to mix, but J.M. Smuckers (SJM:

NYSE) has made water a cause. Smuckers is one of the sponsors of the Mill

Creek Alliance trying to clean up the severely polluted watershed in the

Cincinnati area. Of course, Mill Creek is in the Smucker’s

backyard and it makes sense for the iconic food and beverage company to get

behind the Mill Creek clean up. Even

beyond its home turf, Smuckers is highly dependent upon clean water supplies for

its products. The jam business delivers

6.9% on its shareholders’ stake. The

board of directors is also generous with a consistent dividend that is giving

investors at the current price a 3.37% yield.

Few business

models are more dependent upon quality water than The Coca Cola Company (KO: NYSE). Coke is a beverage producer that has made

clean water a cause. Indeed, Coca-Cola

Latin America sponsored the event that inspired this series - a

panel discussing Latin America’s Mounting Water Crisis hosted by the Americas

Society/Council of the Americas (AS-COA) based in New

York City. Coca-Cola has

pledged to return every drop of water used in its products. That is a meaningful pledge given that by

its own calculations Coca Cola uses over one trillion liters of water each

year.

Accordingly, the

company’s efforts must be sizable. For

example, Coca-Cola supports the National Forest Foundation in

its efforts to restore and manage healthy watersheds. Coca-Cola has funded twelve restoration

projects in six different national forests.

A project in the Carson National Forest in New Mexico is attempting to

restore a meadow habitat along a creek tributary of the Rio Grande River. The project is expected to replenish as much

as 49 million liters of water per year that is ultimately used by the residents

of the city of Santa Fe.

Mixing beverages

is good business or at least in terms of Coca-Cola’s 39.6% return on

shareholder equity. However, that

success comes at a premium valuation of KO shares of 24.4 times 2020 earnings. The company’s directors are not so generous

with dividends and the dividend yield is 2.95% at the current price level.

Neither the author of the Small Cap Strategist web

log, Crystal Equity Research nor its affiliates have a beneficial interest in

the companies mentioned herein.

1 comment:

Hey,

Good article. I was looking for the benefits of backlinks and comes to your site. SharePoint Migration Tool

Post a Comment